Bank Loans 2021: Compare Personal Loans From Banks

Bank Loans 2021: Compare Personal Loans From Banks

Bank loans can have low rates and high borrowing amounts for existing customers with good credit scores, including those with a FICO score of 690 and above.

A bank loan is a personal loan you get from a bank, rather than an online lender or credit union. It can be issued by a large national bank or a smaller local bank.

Rates for personal loans from banks can start as low as 6%, and bank loan amounts can be as high as $100,000. Some banks require you to be an existing customer to be eligible for a personal loan, but not all banks do.

Here are the best banks offering personal loans. Plus, learn about bank loan rates, how to qualify, and loan alternatives.

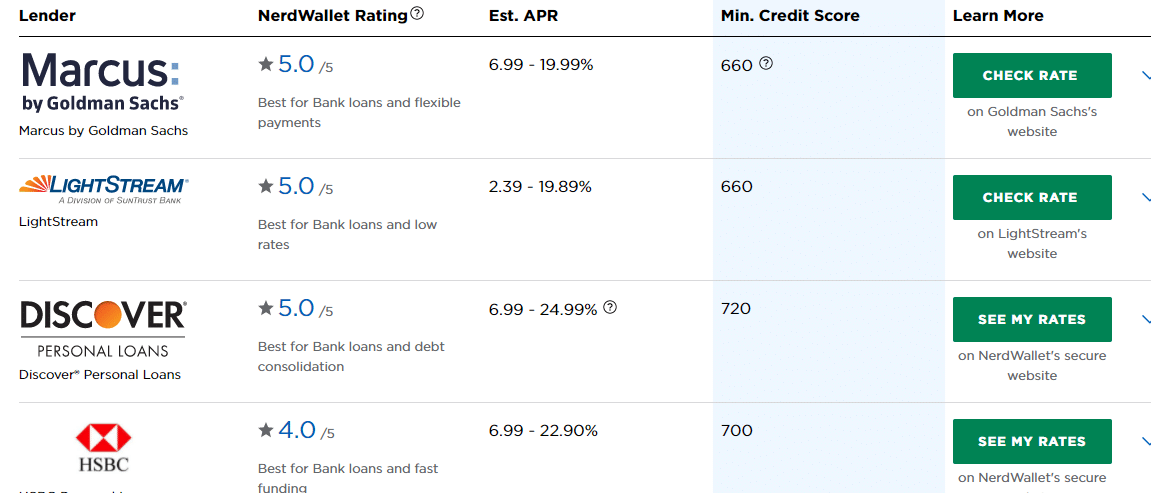

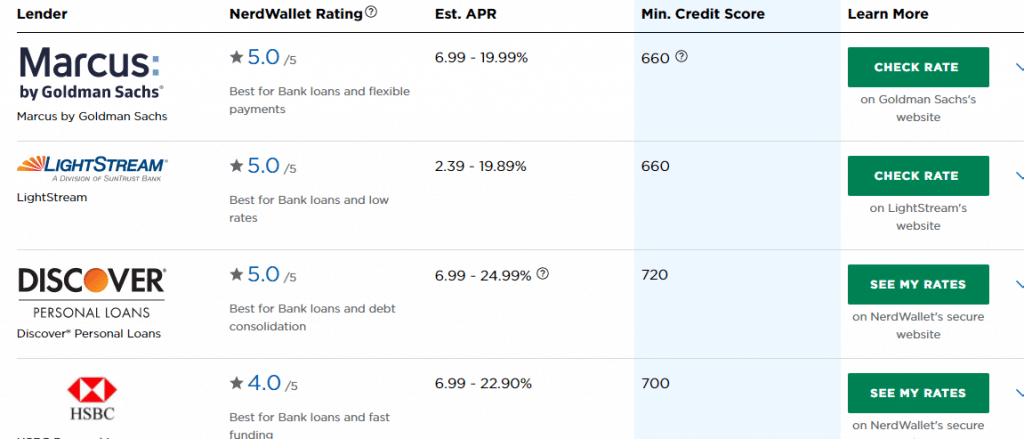

| Lender | NerdWallet Rating | Est. APR | Min. Credit Score | Learn More | |

|---|---|---|---|---|---|

| Marcus by Goldman Sachs | 5.0/5Best for Bank loans and flexible payments | 6.99 – 19.99% | 660 | CHECK RATEon Goldman Sachs’s website | |

| LightStream | 5.0/5Best for Bank loans and low rates | 2.39 – 19.89% | 660 | CHECK RATEon LightStream’s website | |

| Discover® Personal Loans | 5.0/5Best for Bank loans and debt consolidation | 6.99 – 24.99% | 720 | SEE MY RATESon NerdWallet’s secure website | |

| HSBC Personal Loan | 4.0/5Best for Bank loans and fast funding | 6.99 – 22.90% | 700 | SEE MY RATESon NerdWallet’s secure website | |

| PNC Bank Personal Loan | 4.0/5Best for Bank loans and joint borrowers | 7.24 – 25.34% | None | SEE MY RATESon NerdWallet’s secure website | |

| Wells Fargo Personal Loan | 4.5/5Best for Bank loans and large loan amounts | 5.99 – 24.49% | None | SEE MY RATESon NerdWallet’s secure website | |

| American Express | 4.0/5Best for Bank loans and current AmEx members | 6.91 – 19.97% | None | SEE MY RATESon NerdWallet’s secure website | |

| TD Bank Personal Loan | 4.5/5Best for Bank loans and small loan amounts | 6.99 – 21.99% | 700 | SEE MY RATESon NerdWallet’s secure |

Bank personal loan rates

The average annual percentage rate on a two-year personal loan from a bank is 9.34%, according to the most current data from the Federal Reserve. In 2019, the average bank loan interest rate was 10.32%.

As with most credit products, the rate you receive on a personal loan from a bank depends a lot on your credit score. The better your score, the lower your rate and the less interest you’ll pay over the life of the loan. The interest rate also affects your total monthly payment, as does the term length; a longer term means lower monthly payments, but you pay more interest over time.

Use a personal loan calculator to estimate interest and monthly payments on a personal loan, based on your credit score.

» MORE: Best personal loan interest rates

Pros and cons of bank loans

While personal loans from banks are often structured similarly to online loans, the process of getting and qualifying for one may be different. Here are a few pros and cons to consider:

Pros of bank loans

- Banks typically offer lower rates, higher borrowing amounts and perks to existing customers.

- If you already have accounts with the bank, you can keep them all in one place.

- Customer service may be more robust at banks. You may even have the same contact person throughout the life of the loan.

Cons of bank loans

- Many banks require an in-person visit to complete a loan application.

- Few banks offer an online pre-qualification process, so you can’t see what rates and terms you qualify for before applying.

- Costs from operating brick-and-mortar locations may drive up APRs.

» MORE: Should you get a loan online or in person?

Do all banks offer personal loans?

Not every bank offers personal loans. Some, like American Express, offer personal loans only to current customers who receive preapproval. Other banks, like Bank of America, Chase and Capital One, don’t currently offer personal loans at all.

If you apply for a personal loan with a bank or another lender, they may require you to indicate what you plan to use the money for. Typically, people take out personal loans for a variety of purposes, including debt consolidation loans, financing for larger purchases like boats and RVs, or home improvement projects.

How to qualify for bank loans

Bank loans may offer benefits for their customers, but they typically have tougher credit score requirements than online loans.

Some financial planners say having an existing relationship with employees at your bank — whether it’s a small local bank or a large national bank — can help your chances of qualifying. But getting approved often comes down to how you look on paper. Consider these tips for the best chance at qualifying.

- Build your credit. At least a few years of credit history showing on-time payments and no delinquencies will help your application, but avoid opening new accounts right before you apply (it can ding your credit). Check your credit report for errors that may be hurting your score and dispute any errors online.

- Review your credit score. Many banks have a minimum credit score they’ll accept from a borrower, but aim above the minimum requirement for the best chance at a low rate. You can get your free credit score with NerdWallet.

- Boost your income and pay down debt. Lowering the percent of your income that goes to debts, also called your debt-to-income ratio, will be viewed favorably by most lenders. In many cases, lenders want to see that you make at least enough income to cover your existing obligations, plus the loan you’re applying for. Still, the lower your DTI, the better.

- Increase your savings, if you can. Showing a lender that you’ve got enough money in the bank to cover a difficult time can boost their confidence that you’ll make payments on time.

Bank loan alternatives

Whether you’re a loyal bank customer or not, it’s always smart to consider other options for personal loans. The best loan for you is the one with the lowest rate and payments that fit your budget. Here are a few alternatives to getting a bank loan:

Credit unions: These not-for-profit, members-only organizations consider loan applicants’ full financial picture and are more likely to approve borrowers with average credit (FICO score range of 630-689) or bad credit (FICO score range of 300-629). Rates on loans at federal credit unions are capped at 18%.

Online loans: With online lenders, you can complete the entire loan process on a mobile device and get funding within a day or two. Unlike some banks, online lenders typically let you pre-qualify for financing to see your estimated rate. This triggers a soft credit pull, so you can check your rate and terms at several lenders without impacting your credit score.

Home equity loans and HELOCs: This may be a lower-cost borrowing option if you have equity in your home, but you also risk losing it if you fail to repay the loan.

How to pre-qualify for an online personal loan

Taking the steps to pre-qualify for an online loan lets you see potential loan terms, including the loan’s interest rate, without hurting your credit. You can pre-qualify with multiple lenders on NerdWallet to compare offers and find the lowest rate.