The Ranging Market Everything to Know

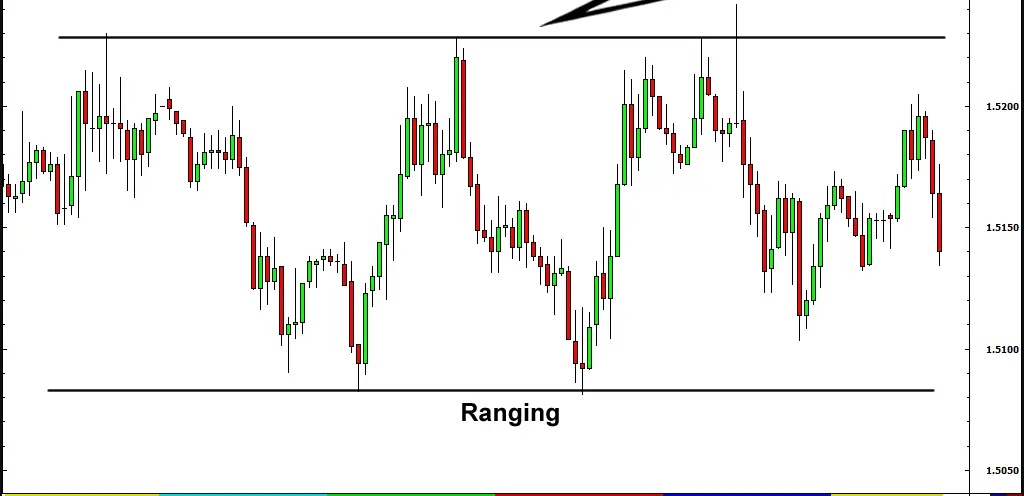

Ranging Market is straight forward markets, and they are often called sideways markets, because their neutral nature makes them appear to be drifting to the right, horizontally. When the market makes a series of higher highs and higher lows, we can say that the market is trending up.

But when it stops making these series of peaks, we say that the market is volatile. The Ranging Market moves in a horizontal form, as the buyers and sellers keep moving the price back and forth between the support and the resistance level.

The difference between trending and Ranging Market is that the directional markets tend to move by forming a pattern of higher lows and higher lows in the case of an uptrend, and higher lows and lower lows in the case of a downtrend.

But the swing markets tend to move horizontally between major support and resistance levels. Your understanding of the difference between the two markets will help you to better use appropriate price action strategies in the right market conditions. Range trading markets are completely different from trend markets because when the market is volatile it creates an equilibrium, the buyers are equal with the sellers, and there is no one controlling it.

This will generally continue until the scale structures erupt, and the trend state begins to regulate. The best buying and selling opportunities occur at major support and resistance levels. There are three ways to trade the tiered markets, I won’t go into detail, because what I want you to get here is the skill to look at your charts and determine if the market is trending or a range.

If you cannot distinguish between Ranging Market and trending markets, you will not know how to use these price action strategies. The first way to trade range markets is to wait for the price to approach a support or resistance level, then you can buy at the major support level and sell at the major resistance level.

The second way to trade range markets is to wait for a breakout from a support or resistance level. When the market is scaling, nobody knows what will happen, we do not know who will control the market, which is why you have to pay attention to the limits, but when one of the players decides to dominate the market, we will see a breakout of the support or resistance level.

A breakout means that the period of the range is over, and a new trend will start …

So the best way to get in is after the breakout

It is important to remember that range boundaries are often crossed, giving the illusion of a breakout, and this can be very deceptive, and puts many traders in the spot of the breakout. The third way to trade in the range markets is to wait for a pullback after a support or resistance level is breached. Pulling back is another opportunity to join the trend for traders who haven’t yet entered the breakout.

After the breach, the market returns to retest the resistance that becomes support before rising. Pull back is your second chance to join the buyers if you miss the breakout. But pullbacks don’t always happen after every breakout – when they do, they are a great opportunity with a good risk to reward ratio.

What you need to remember is that the range market is moving horizontally between support and resistance level. These are the main levels that you need to focus on. A breakout of the support or resistance indicates that the range period is over, so you need to make sure that the breach is real to join the new trend safely.

If you miss the hack, wait for withdrawal. When this happens, feel free to enter the market. When trading in the listed markets, always make sure the market is worth trading, if you feel you cannot define boundaries (support and resistance). This is a clear indication of a choppy market.

In Forex, volatile markets are those that do not have clear trends, when you open your chart, and you get a lot of noise, you cannot even decide whether the market is trending or trending. You need to know that you are viewing a volatile market. This type of market can leave you feeling extremely emotional and suspicious of your trading strategies when performance starts to decline.

The best way to determine if the market is volatile is just to zoom out on the daily chart and take the bigger picture. After some training, screen time, and experience, you will easily be able to determine if the market is a volatile market or if it is a volatile market.

If the market is volatile, in my opinion, it is not worth trading, and if you try to trade it, you will soon return your profits from the big winners, because the markets often consolidate after making big moves.

![Makato Ya NBC Bank Tanzania 2024 [Tariff guide, Charges & Fees] 13 Nbc](https://allglobalupdates.com/wp-content/uploads/2021/10/Capture-36-280x210.png.webp)

Leave a Reply