In Tanzania, income tax is calculated based on the Pay As You Earn (PAYE) system. This means that income tax is deducted from your salary before you receive it. The Tanzania Revenue Authority (TRA) provides a calculator on their website that allows you to determine your income tax payable. In this article, we will discuss how to use the PAYE Calculator TRA Tanzania to calculate your income tax payable.

What is the PAYE Calculator TRA Tanzania?

The PAYE Calculator TRA Tanzania is an online tool provided by the TRA that allows taxpayers to calculate their income tax payable.

The calculator takes into account your monthly salary after deducting the National Social Security Fund (NSSF) or Public Service Social Security Fund (PSSSF) contribution. It then calculates the amount of income tax you need to pay based on the tax rates set by the government.

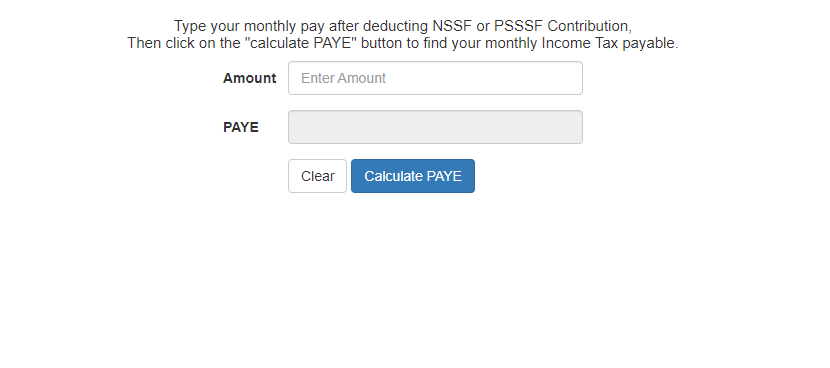

PAYEE Calculator TRA

How to Use the PAYE Calculator TRA Tanzania

Using the PAYE Calculator TRA Tanzania is a straightforward process. All you need to do is follow the steps below:

- Visit the TRA website at https://www.tra.go.tz/calculators/paye.htm

- Type in your monthly pay after deducting the NSSF or PSSSF contribution.

- Click on the “calculate PAYE” button.

Once you click on the “calculate PAYE” button, the calculator will display the amount of income tax you need to pay based on the tax rates set by the government.

Understanding the Results

The results of the PAYE Calculator TRA Tanzania are displayed in two sections. The first section shows your gross salary, which is your monthly salary before any deductions are made. The second section shows your net salary, which is your monthly salary after deducting the NSSF or PSSSF contribution and income tax.

The amount of income tax you need to pay is calculated based on the tax rates set by the government. The tax rates are progressive, which means that the more you earn, the higher your tax rate. The current tax rates in Tanzania are as follows:

- 0% for monthly income up to TSH 170,000

- 9% for monthly income between TSH 170,001 and TSH 360,000

- 20% for monthly income between TSH 360,001 and TSH 720,000

- 25% for monthly income between TSH 720,001 and TSH 1,500,000

- 30% for monthly income above TSH 1,500,000

Conclusion

The PAYE Calculator TRA Tanzania is a useful tool that allows taxpayers to calculate their income tax payable. By using the calculator, taxpayers can get an idea of how much income tax they need to pay based on their monthly salary after deducting the NSSF or PSSSF contribution. Understanding how to use the calculator can help you plan your finances better and ensure that you meet your tax obligations on time.