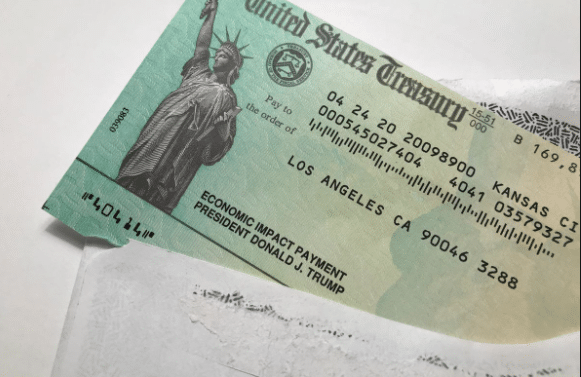

Stimulus Checks: How much is the stimulus payment? & Other important Details

How much is the stimulus payment?

Eligible individuals can receive a motivational check of up to $ 600. Spouses who file joint tax returns can receive up to $ 1,200. Families with children under the age of 17 can get an additional $ 600 per child. Dependents 17 years and over are not eligible to receive a check. People who are US citizens but are applying jointly with someone who is not a citizen will be eligible for motivation screening, which was not the case with the first round of stimulus payments. Motivational checks are not taxable.

Will anyone receive a Stimulus check that did not file a tax return in 2019?

Some people will. According to the House Appropriations Committee, eligible Social Security recipients and railroad retirees who are not normally required to file a tax return will automatically receive a $ 600 incentive check. The IRS will use the information on annual tax forms SSA-1099 and RRB-1099 to automatically generate incentive checks. Social Security Disability Insurance (SSDI) recipients also receive SSA-1099 tax forms and will automatically receive $ 600 in incentive checks. In addition, the House Appropriations Committee says that VA recipients and SSI recipients will receive automatic checks of $ 600.

When can I expect to receive my Stimulus check?

The IRS will begin handing out checks as early as the last week of December. Most of people will get their checks via electronic bank deposit, which is the fastest way. Generally speaking, if you get the first incentive check via electronic bank deposit, you will get the second this way as well.

What information do I need to use the motivation screening calculator?

The calculator asks for three things: the status of the tax deposit (single, married, separately married file, head of household, or widower or eligible widower); Your adjusted gross income (AGI) from your 2019 tax return; And the number of children under the age of 17 who have claimed dependents.

Is there an income limit to receive the Stimulus Check?

Yeah. An individual with an AGI of up to $ 75,000 will receive the $ 600 check in full; A couple who jointly apply (or someone whose wife died in 2020) with an AGI of up to $ 150,000, will receive $ 1,200 ($ 600 for each eligible person). The head of household file holder who has an AGI of up to $ 112,500 will receive the $ 600 check in full.

The amount of stimulus screening is gradually reduced once the general AI exceeds these limits. An individual (whether single file or separately married file) with an AGI higher than $ 87,000, will not receive a motivational check. The couple presenting together won’t receive a motivational check once the AGI crosses $ 174,000. Anyone applying as a head of household with an AGI higher than $ 124,500 will not receive an incentive check.

How does the incentive verification calculator estimate reduced payments?

Once the file’s AGI reaches the income threshold for the full stimulus check, the payment amount is reduced by $ 5 for every $ 100 above the limit. The payment amount is completely phased out once the applicant’s AGI exceeds the maximum AI for the registration status. Our calculator uses an IRS discount rate ($ 5 for every $ 100 above the minimum) to calculate an estimated stimulus check based on the information you provide.

Can I use the calculator if I do not file a tax return for 2019?

Yeah. Even if you haven’t filed a tax return, you can estimate your general AI and input the amount into the calculator to get a rough estimate of potential stimulus payments. Adjusted gross income, as the name suggests, is your total income (wages, dividends, capital gains, retirement distributions, and other earnings) minus some adjustments such as teacher expenses, student loan benefits, alimony payments, and qualifying contributions to retirement accounts. You can find AGI on line 8b of your 2019 federal income tax return 1040.

If you are not required to file a federal tax return because of your income level, you can wait until 2021 and file a tax return for 2020 using Form 1040 or 1040 SAR to claim the second stimulus payment. If you are not able to claim a previous $ 1,200 motivational check, you can do so on the 2020 tax forms as well.

Can I contact the Tax Authority for more information about the stimulus checks?

Yes, the tax authority’s toll-free phone is 800-919-9835.

Source AARP.Org