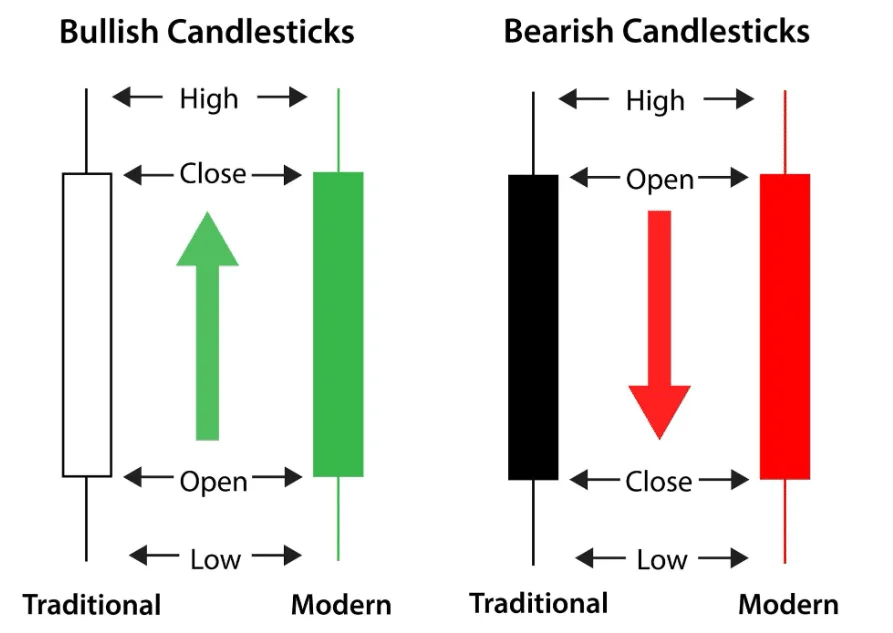

What is Candlestick patterns?

Candlestick patterns are one of the strongest trading concepts. They are simple, easy to identify and very profitable settings, and one research has confirmed that candlestick patterns have a high predictive value and can lead to positive results.

Candlestick patterns are the language of the market, imagine that you live in a foreign country and do not speak the language.

How would you survive if you couldn’t even say a word? Difficult right ??? The same when it comes to trading.

If you know how to read candlestick patterns the right way, then you will be able to understand what these patterns tell you about market dynamics and trader’s behavior.

This skill will help you to better enter and exit the market at the right time. In other words, this will help you act differently in the market and make money by following the smart guy’s footprints.

The Following Are Candlestick patterns;-

1.The engulfing bar candlestick pattern

The engulfing bar forms as mentioned in its title when it engulfs the preceding candle completely. A swallow bar can engulf more than one previous candle, but for it to be considered bar ingestion, at least one candle must be consumed in its entirety.

One of the most important candlestick patterns is a bearish engulfing. This candlestick pattern consists of two objects.

2.The bullish engulfing candle pattern

The bullish engulfing bar consists of two candles, the first is the small body, and the second is the sunken candle,

The bullish engulfing bar pattern is telling us that the market is no longer under the control of the sellers, and the buyers will control the market.

When a bullish engulfing candle forms in the context of an uptrend, it signals a continuation. When a bullish engulfing candle forms at the end of a downtrend, the reversal is much stronger as it represents a capitulation low.

3.Doji candlestick pattern

Doji is one of the most important patterns of Japanese candlesticks, when this candlestick forms it tells us that the market opens and closes at the same price, which means that there is equality and hesitation between buyers and sellers, and there is no one controlling the market.

Doji candle formation indicates that buyers are unable to keep price higher, and sellers are pushing prices up to opening price. This is a clear indication of a possible trend reversal. Always remember that Doji refers to equality and indecision in the market, you will often find it during breaks after big moves up or down.

If you are already heading in this direction, it is time to take profit, and it can also be used as an entry signal if combined with other technical analysis.

4.Dragonfly Doji Pattern

Dragonfly doji is a bullish candlestick pattern that forms when the opening and closing price is the same or close to the same price. The dragonfly doji is distinguished by its long lower tail that shows the resistance of the buyers and their attempt to push the market up.

The formation of a dragonfly doji with a long lower tail demonstrates that there is high buying pressure in the area. If you can spot this candlestick pattern on your chart, it will help you visually see when support and demand is present.

When it occurs in a downtrend, it is interpreted as a bullish reversal signal. But as I always say, you cannot trade the candlestick pattern alone, you will need indicators and other tools to identify high probability dragonfly doji signals in the market.

5.The tomb of the Doge

The Gravestone Doji is the downward version of the dragonfly Doji, and it forms when the opening and closing are the same or nearly the same price. What distinguishes the Gravestone Doji from the Dragonfly Doji is the long upper tail. The formation of the long upper tail is an indication that the market is experiencing a strong supply or resistance area.

This pattern indicates that while the buyers were able to push the prices higher than the opening. Later in the day, the sellers swept over the market and pushed the price down again. This is interpreted as a signal that the bulls are losing their momentum and the market is ready for a reversal.

This candlestick formation indicates that the buyers are no longer in control of the market. For this pattern to be reliable, it must occur near the resistance level.

As a trader, you will need additional information about the position and context of the Doge’s tomb to effectively interpret the sign. This is what I will teach you in the following chapters.

- The morning star

The morning star pattern is considered a bullish reversal pattern, and it often occurs at the bottom of a downtrend and consists of three candlesticks: – The first candle is bearish, which indicates that the sellers are still responsible for the market.

. – The third candle is a bullish candle that opened at the open and closed above the midpoint of the body on the first day, and this candle carries an important directional reversal signal.

7.Evening star pattern

The evening star pattern is a bearish reversal pattern that usually occurs at the top of an uptrend. The model consists of three candlesticks:

The first candle is a bullish candle

The second candlestick is a small candlestick, which can be bullish or bearish, or it can be a doji or any other candlestick.

The first part of the evening star is a bullish candle; This means that the bulls are still pushing the market higher. Now, everything is going well.

The smaller body formation shows that the buyers are still in control but not as strong as they have been. The third bearish candle indicates that the buyer’s dominance is over, and a reversal of the potential downtrend is likely.

- Hammer (pin bar)

Hammer candle is created when the opening and closing price is approximately the same; It also has a long lower shadow that indicates an upside rejection from buyers and their intent to push the market higher.

The hammer is a reversal candlestick pattern when it occurs at the bottom of a downtrend.

This candle is formed when the sellers push the market lower after the opening, but are rejected by the buyers, so the market closes above the lowest price.

- The shooting star (bearish pin bar)

A shoot-out formation is formed when the open and close low are roughly the same price, this candle has a small body and a long upper shadow. It is the downward version of the hammer. Professional technicians say the shadow should be twice the length of the real body.

The psychology behind this pattern formation is that buyers try to push the market higher, but get rejected due to selling pressure.

When this candle is formed near the resistance level. It should be taken as a high likelihood setting.

This candlestick pattern can be used with support and resistance, supply and demand areas, and with technical indicators. The shooting star is very easy to spot, and so profitable, it is one of the strongest signals I use to enter the market.

- The Harami Pattern (the inside bar)

Harami (Japanese Stand) is a reversal and continuation pattern, consisting of two candlesticks:

The first candle is the big candle, called the parent candle, followed by a smaller candle called the small candle. For the Harami pattern to be valid, the second candle must close outside the previous candle.

This candle is a bearish reversal signal when it occurs at the top of a bullish trend, and it is a bullish signal when it occurs at the bottom of a downtrend.

The Harami candle is telling us that the market is going through a period of hesitation. In other words, the market is consolidating. So, the buyers and sellers do not know what to do, and no one is controlling the market.

When this candlestick pattern occurs during an uptrend or downtrend, it is interpreted as a continuation pattern that gives a good opportunity to join the trend. If it occurs at the top of an uptrend or at the bottom of a downtrend, it is considered a trend reversal signal.

11.The Tweezers tops and bottoms.

TheTweezers top formation is considered as a bearish reversal pattern appearing at the top of the uptrend, and the Tweezers bottom formation is interpreted as a bullish reversal pattern appearing at the bottom of the downtrend.

The shape of the top of the tweezers consists of two candles: the first is a bullish candle, followed by a bearish candle.

The bottom of the tongs also has two candles. The first bearish candle, followed by a bullish candle. So we can say that the bottom of the tweezers is the ascending version of the Tweezers top.

The top of the Tweezers occurs during an uptrend when the buyers push the price higher, giving us the impression that the market is still going up, but the sellers surprised the buyers by pushing the market down and closing the opening of the bullish candle. This price action pattern indicates a reversal of the uptrend and we can trade it if we can combine this signal with other technical tools.

Leave a Reply