What is a candlestick?

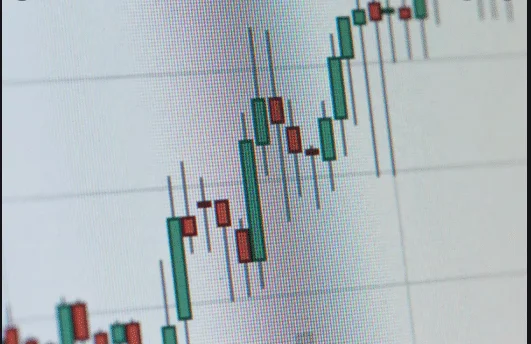

Candlesticks;- are formed using the open, high, low, and close of the chosen time frame.

- If the close is above the open, then we can say that the candle is bullish, which means that the market is rising in this time period. Bullish candlesticks always appear as a white candlestick.

Most trading platforms use white to indicate bullish candlesticks. But the color doesn’t matter, you can use any color you like. The most important is the opening and closing price. - If the close was below the open, then we can say that the candlestick is bearish, indicating that the market is declining in this session. Bearish candles are always displayed as black candles. But this is not a rule.

You can find different colors used to distinguish between bullish and bearish candlesticks.

The filled part of the candle is called the real body.

Fine lines that appear above and below the body are called shadows. - The upper part of the upper shadow is the top. – Below the lower shadow is the low.

Candlestick body sizes:

Candles have different body sizes:

- Long bodies

Long bodies indicate strong buying or selling pressures, if there is a candlestick the close is above the open with a long body, this indicates that the buyers are stronger and that they are controlling the market during this time period.

On the contrary, if there is a bearish candle in which the open is higher than the close with a long body, this means that the selling pressure is controlling the market during this chosen time frame. Short and small bodies indicate little buying or selling activity.

- Candlestick shades (tails)

The upper and lower shadows give us important information about the trading session.

- The upper shadows denote the raised session

- Lower shadows denote that the session’s lower candlesticks with long shadows show that the trading action occurred after the opening and closing.

Japanese candlesticks with short shadows indicate that most of the trading movement was confined to near the opening and closing. - If the candlestick has a longer upper shadow, and a short lower shadow, this means that the buyers have flexed their muscles and raised the bid price. But for one reason or another, the sellers came in and pushed the price down again to end the session again near the opening price.

- If the Japanese candlestick has a long lower shadow and a short upper shadow, this means that the sellers flashed the washboard abdomen muscles and forced the price down. But for some reason, another buyer came in and pushed prices up again to end the session again near the opening price

![Makato Ya NBC Bank Tanzania 2024 [Tariff guide, Charges & Fees] 13 Nbc](https://allglobalupdates.com/wp-content/uploads/2021/10/Capture-36-280x210.png.webp)

Leave a Reply