EFD | Electronic Fiscal Device | E-Fiscal Devices (EFD)

What is the Electronic Fiscal Device (EFD) (EFD)

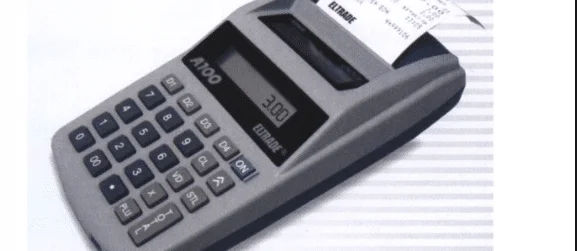

Electronic Fiscal Device (EFD) is a machine designed for use in business for effective management controls in the areas of sales analysis and inventory control system that comply with the requirements specified by laws.

Types of Electronic Fiscal Device (EFD)

Electronic Tax Register (ETR)

The device is used by retail companies that manually issue receipts.

Electronic Tax Printer (EFP)

The device is used by computerized retail outlets. It is connected to a computer network and stores all sales transactions or details that take place in its financial memory.

Electronic signature device (ESD)

The device is designed to authenticate by signing any financial document produced on a personal computer (PC) such as a tax invoice. The machine uses a special computer program to create a unique signature number that is appended and printed on every bill issued by the user’s system.

Electronic Financial Pump Printer (EFPP)

The device is designed for use at petrol stations. It is connected to a pump and every receipt is printed during sales transactions.

Noticeable:

You are obligated to issue a receipt or invoice for each sale and notify the authorized representative of any changes / malfunctions in the device within 24 hours. The hardware supplier will install, configure and attend to the fault of the device within 48 hours

The second stage of the EFD

The implementation of the second phase of the Electronic Financial Devices (EFD) began in 2013, with the aim of increasing the number of traders who will use the EFD system to issue receipts or tax invoices in every transaction that takes place. The second phase includes merchants who are not registered in the VAT and administered under the Tax Administration Law of 2015,

The implementation of the EFD phase II should include the following groups;

I am. Persons not registered for VAT with a sales volume of 14 million TSHS and above per year;

Second. Merchants trading in prime areas of the region, who are determined on the basis of rent payable;

Third. Traders who deal with select business sectors such as spare parts, appliances, small supermarkets, gas stations, cell phone stores, subsidiary wholesale stores, bars and restaurants, and drug stores; Online stores etc.

The system is ongoing, and the authority will gradually register merchants based on the prosperity of merchants’ business, experience and capabilities

Leave a Reply