There are a lot of job opportunities in the consumer services sector. These jobs are available in sales, marketing, customer service, and support. The pay is often higher than other jobs that require a similar amount of education or experience but they can vary depending on the industry and company size.

Consumer services are the industry with the highest number of job openings in the United States. In California, for example, nearly 40 percent of job openings are in this industry. This is because many companies that sell products or services to consumers need a wide range of skills and experience to effectively communicate with their customers.

“Consumer services” is a very broad category that encompasses everything from IT to sales, but each of these types of jobs pays in vastly different ways. In this article, we’ll take a look at the highest paying positions in consumer services and discuss what you should do to set yourself on the path for success. First, let’s examine the most important numbers:

10 Best Paying Jobs in Consumer Services

Consumer Services

1. Computer and Information Systems Manager

Computer and information systems managers are responsible for the management of computer systems, including their implementation, maintenance and support. These professionals can work in any industry that uses technology to help run its business. For example, a computer and information systems manager might work at a company that offers cloud-based solutions or has developed an app that helps people manage their finances.

They are responsible for developing strategic plans based on current technologies;

- finding new ways to implement these technologies;

- developing policies and procedures governing them;

- managing budgets associated with these technologies;

- managing staff who oversee their implementation;

- selecting vendors who can provide these services;

- identifying potential problems before they occur (and fixing them when they do);

- training employees on how best to use any new technology introduced into the workplace;

ensuring compliance with relevant laws/regulations regarding privacy issues associated with using software programs such as Microsoft Word or Excel spreadsheets containing sensitive personal data about customers’ credit card numbers

2. Chief Operating Officer (COO)

As a Chief Operating Officer (COO), you’ll be in charge of leading a company’s overall operations, including its strategic planning, human resources and finance departments. As such, you have to have the ability to multitask, manage multiple projects at once and maintain strong relationships with high-level executives at other companies.

The average annual salary for this position is $139K; however, it can vary widely depending on where you work and what kind of company you’re running. For example:

- A COO working as an executive at General Electric earns around $1 million per year;

- A COO working for Amazon typically earns between $200K and $300K annually; and

- The highest paid COOs usually work for oil companies like Exxon Mobile or Shell Oil Company where they earn over half a million dollars each year!

3. Sales Director

A sales director is responsible for the successful operations of a company. The position is a high-level managerial role that requires extensive knowledge of business and leadership skills.

A sales director must understand how to increase revenue, develop effective strategies for marketing products to consumers, and effectively manage their department’s resources. They must also have excellent communication skills so they can communicate effectively with colleagues while maintaining positive relationships with clients or customers.

The duties of this job include managing a team of workers who assist in selling products or services; developing long term strategies for product development; planning budgets; overseeing advertising campaigns; finding new markets for selling goods or services; making presentations to potential clients about what products can offer them (if you don’t know what these things are yet this really isn’t the best job for you).

Sales directors usually need at least 5 years experience working as either an assistant manager or division manager before they can apply for this position. The average salary range is between $85k-$200k depending on where you work but most people make around $130k per year which means there’s plenty of room if someone wants something better than minimum wage!

4. Vice President of Operations

Vice Presidents of Operations are responsible for managing the daily operations of a company. They plan and direct all activities within a firm’s production, distribution, sales and service areas.

As VP of Operations, you will be required to manage a team that can include everything from manufacturing workers to store managers to marketing specialists. You’ll also be responsible for solving problems related to your company’s operations.

The salary range for Vice President of Operations is $101,000-$182,000 annually with an average salary being $142,000 per year

5. General and Operations Manager

As the general and operations manager, you’ll be responsible for managing the day-to-day operations of a consumer services business. This includes everything from hiring and training employees to scheduling shifts, managing inventory levels and making sure that all systems are running smoothly.

A G&O manager for this kind of company will typically have at least an associate’s degree in business administration or management experience in another industry. Many employers also require some sort of certification from a professional organization such as the International Society for Performance Improvement (ISPI).

The average salary for a G&O manager varies depending on where you work—the Bureau of Labor Statistics lists it at $72,000 per year—but remember that these numbers do not account for any bonuses or benefits like health insurance or paid time off.

6. Actuarial Mathematician

An actuary is a professional who analyzes, models and manages the financial costs and risks of events. Actuaries work in insurance, banking, investment management and retirement planning.

According to the Bureau of Labor Statistics (BLS), there were just over 132,000 actuaries working in 2016. Most were employed by life or health insurance carriers as well as state or federal governments.

Actuaries must complete undergraduate courses in mathematics and statistics, followed by graduate education leading to a master’s degree or doctorate in mathematics or statistics from an accredited university program.

On average, college graduates with degrees in actuarial science can expect to earn around $75,000 per year — but this figure varies widely depending on factors such as employer type (whether they’re working for an insurance company vs government), location within the United States (big city vs rural area), experience level (more senior employees tend to make more money) etcetera…

7. Director of Client Services

If you’re a people person, the director of client services job might be for you. Directors of client services are responsible for managing the relationship between a company and its customers or clients. They oversee all aspects of customer service, from handling inbound calls to managing internal communications about customer issues. In many cases, directors also handle marketing and business development activities related to their clients’ needs.

The director of client services role has both a high level of responsibility and high-level pay associated with it: according to SalaryExpert’s data on this job, the median salary is $80,000 per year (roughly $26 per hour). Directors who excel at their jobs can earn significantly more than this amount—for example, Glassdoor reports that one company pays its director $110K/year while another offers an even more impressive $166K/year paycheck!

8. Chief Financial Officer (CFO)

As the chief financial executive of a company, you’ll be responsible for managing its finances and ensuring they are used effectively. You’ll be responsible for making sure that the company has enough cash on hand to operate on an ongoing basis and that there is enough money available to pay employees and suppliers.

In addition to financial management, CFOs are also tasked with providing information about their organization’s financial performance through quarterly earnings reports or annual budgets. This includes reviewing sales data from previous quarters as well as current projects and services being offered by the firm in question.

9. Sales Manager

The sales manager is the top of the sales hierarchy and is responsible for the entire team, including hiring, training and leading them to success. As a result of this responsibility, they get compensated accordingly. A sales manager can expect an average salary of $63K per year with top earners making over $100K annually (according to Glassdoor).

Sales managers are also responsible for their team’s performance so if your company sells something like cars or insurance where there are multiple levels of selling involved then you might want to consider hiring a few people here since it will help increase overall profits by increasing revenue per employee at each stage in your business process.

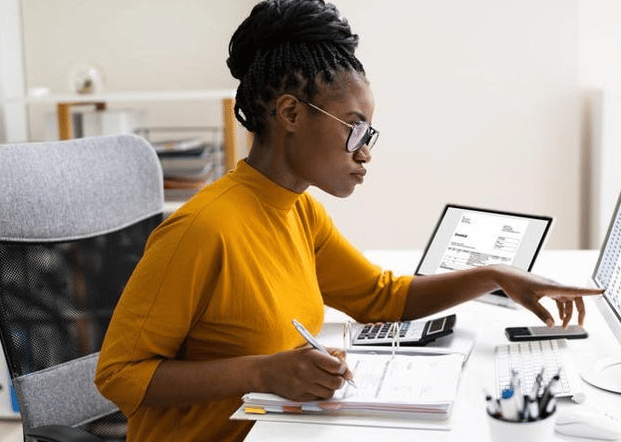

10. Financial Analyst

A financial analyst is an individual who analyzes the financial status of a company or an organization. This means that they study the sales, expenses, profits and losses of a business in order to recommend the best strategy for increasing profit.

Financial analysts may be required to have a bachelor’s degree in finance or business administration along with excellent analytical skills. Those who are looking for employment as a financial analyst should also possess strong communication and interpersonal skills plus an ability to work well under pressure.

Financial Analyst

Financial analysts are in high demand by businesses around the world because they can play an indispensable role when it comes to helping companies increase profits while saving money on expenses at the same time.

“Consumer services” is a wide-ranging industry that pays in vastly different ways

A consumer service job is not a job that necessarily requires a degree. It covers a wide range of industries and processes, including customer care and support, marketing, sales and distribution. That said, there are certainly many opportunities within this industry for those who want to work in sales or marketing — as long as you have the right skills set.

One thing you can count on in consumer services: The pay varies widely based on the position you take and your level of experience. Some jobs might pay $20 an hour; others could pay up to $50 or $60 an hour depending on how much experience you have under your belt. As such, it’s important to know what type of work environment will best suit your personality before jumping into any new opportunity that comes along.

Conclusion

If you want to get into the consumer services industry, there are many ways to break in. You can start with a role in operations or sales and work your way up the ladder. Alternatively, if you have an advanced degree, you may be able to get into the upper echelons of management right away by working as a computer and information systems manager, sales director or actuarial mathematician.

If money is what motivates you, then look no further than operations management—the best-paid jobs in this industry tend to involve managing other people’s day-to-day activities.