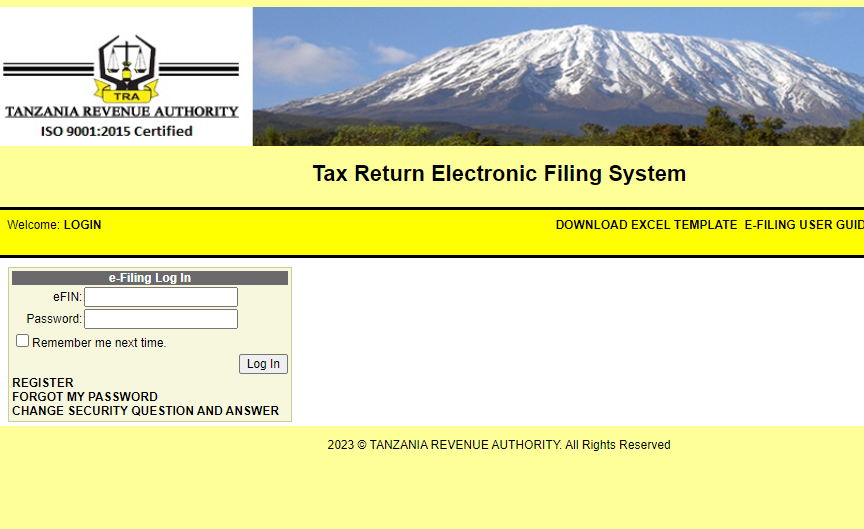

The Tanzania Revenue Authority (TRA) has introduced an electronic filing system that allows taxpayers to file their tax returns online. This system can be accessed through the TRA Tax Return Electronic Filing System Login, which is available on gateway.tra.go.tz/Efiling/login.

In this post, we will discuss how to log in to the TRA Tax Return Electronic Filing System and how to register for this service.

Tax Return Electronic Filing System

The Tax Return Electronic Filing System is a web-based platform that enables taxpayers to file their tax returns electronically.

This system has simplified the tax filing process by providing a fast, secure, and convenient way for taxpayers to file their returns online. The system also reduces the amount of time and resources required for manual filing of tax returns.

Tax Return Electronic Filing System

Welcome: LOGIN

To log in to the TRA Tax Return Electronic Filing System, you need to visit the gateway.tra.go.tz/Efiling/login page. Once you’re on the page, you will see the “Welcome: LOGIN” message. Under this message, there are two fields for eFIN and Password. Enter your eFIN and password to access the system.

DOWNLOAD EXCEL TEMPLATE

Before you start filing your tax returns electronically, you need to download the Excel template provided on the TRA Gateway. This template contains all the fields that you need to fill in to complete your tax returns. The Excel template is easy to use, and it saves you time since you don’t have to manually fill in the fields.

E-FILING USER GUIDE

If you’re new to electronic filing and need some guidance, you can download the E-Filing User Guide provided on the TRA Gateway. This guide provides step-by-step instructions on how to file your tax returns electronically.

Also Check Out;

- Tanzania Revenue Authority Gateway TRA gateway.tra.go.tz

- TRA Gateway login Register Guide gateway.tra.go.tz/payment

E-FILING FAQS

The TRA Gateway also provides a Frequently Asked Questions (FAQs) section, where you can find answers to the most common questions about electronic filing. This section is helpful for taxpayers who are new to the system and need some clarification on various aspects of electronic filing.

e-Filing Log In

If you don’t have an account with the TRA Tax Return Electronic Filing System, you need to register to use this service. To register, click on the “REGISTER” link on the gateway.tra.go.tz/Efiling/login page. Once you’re on the registration page, you need to fill in the required fields to create your account.

FORGOT MY PASSWORD

If you forget your password, you can use the “FORGOT MY PASSWORD” link to reset your password. You will be required to enter your eFIN and answer the security question that you provided during registration. Once you’ve answered the question correctly, you will be prompted to enter a new password.

CHANGE SECURITY QUESTION AND ANSWER

If you want to change your security question and answer, you can use the “CHANGE SECURITY QUESTION AND ANSWER” link to do so. You will be required to enter your eFIN and current password before you can change your security question and answer.

Final Thoughts

In conclusion, the TRA Tax Return Electronic Filing System is a great platform that simplifies the tax filing process for Tanzanian taxpayers. Whether you’re a new user or an experienced user, the TRA Gateway provides all the tools and resources you need to file your tax returns electronically.

So, why not take advantage of this system and simplify your tax filing process today? Remember, the deadline for filing tax returns is approaching, so don’t wait until the last minute to file your returns.