With the recent advances in technology, finance has grown exponentially. Nowadays, with the rise of fintech and changes to global finance regulations, banks are hiring more and more bankers to keep up with these new developments. One of the most common positions is a Financial Services Sales Executive who is responsible for generating revenue from advertising and providing customer service.

Finance professionals are a diverse group of individuals who work in the financial markets. They are often in high demand, which can make their job very lucrative. This article discusses some of the best paying jobs in finance that require surprisingly little experience or education.

If you want to make a lot of money in finance and consumer services, you’re in luck. There are plenty of jobs out there where you can make six figures (and often seven or eight) if you’re talented enough. If you want to make the big bucks,

Here are 10 of the best paying careers:-

1. Hedge-Fund Manager

Hedge funds are pools of money that are invested in the hope of making a profit. Hedge funds are often used to invest in risky assets like stocks, bonds, and commodities. Hedge-fund managers are in charge of managing the fund’s assets. They usually have an investment horizon of three years or more and seek to achieve capital growth over time through active trading strategies.

2. Chief Executive Officer (CEO)

As the highest-ranking executive in a company, the CEO has to manage all aspects of running a business. This includes overseeing sales and marketing efforts as well as making sure that all employees are properly trained and working together towards common goals. The pay for CEOs is often significant—the average salary for executives is $140,000 but CEOs can make well over $1 million per year.

A CEO’s responsibilities also include setting long-term strategy for their companies; they have to think about where they want their businesses to be in five years or ten years time and then plan how they’re going to get there.

3. Chief Financial Officer (CFO)

Chief Financial Officer (CFO)

A Chief Financial Officer is a senior finance executive in a company who is responsible for the company’s finances. The CFO can be the CEO or a subordinate, depending on their company’s structure. A CFO is responsible for creating financial statements such as balance sheets and income statements so that investors know how well their investments are performing.

4. Management Consultant

Management consultants are hired by companies to help them improve their operations. They work with company executives to determine what the company’s goals are and how to achieve them, and they also help companies implement changes that make them more efficient.

Management consultants can make a lot of money and often have flexible schedules, which makes this a great career option for people who want to work from home or travel frequently.

5. Investment Banker

An investment banker helps companies raise money by raising capital from investors. The most common way to do this is through issuing stocks, which means selling shares of the company to the public. It’s a long and complex process.

An investment banker’s salary varies significantly by company and experience level. However, as a general rule they can expect to earn six figures or more annually (on average). Investment bankers tend to work long hours in a high-pressure environment, but they also benefit from some job security due to their expertise in handling investments for large corporations or institutions like banks or governments.

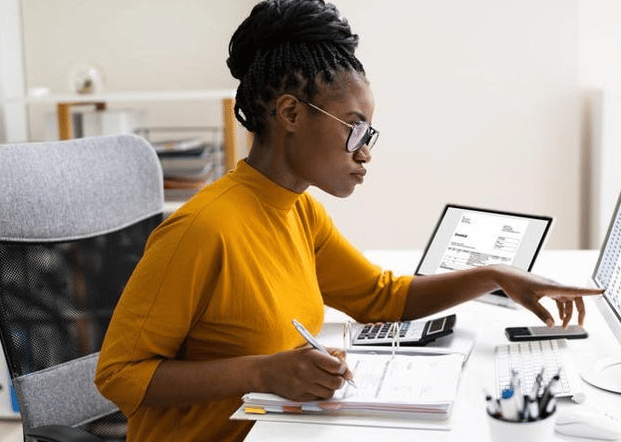

6. Accountant

An accountant is a financial professional who analyzes and interprets financial information, prepares tax returns, and provides advice on matters relating to money. Accountants work in a variety of industries and can hold positions as accountants or auditors.

Accountants perform many duties, including:

- Compiling information about the cost of goods sold or services provided by a business

- Calculating loan payments (including interest) based on annual percentage rates (APRs)

- Monitoring inventory levels

7. Financial Manager

Financial managers are responsible for the financial health of a company. They manage the finances of a company, including the budget and cash flow. Financial managers also research new ways to invest that can help increase profits in the future.

If you want to become a financial manager, you will need a bachelor’s degree in finance or business administration from an accredited college or university. You may also want to consider taking classes on accounting at your local community college or learning how to use Excel spreadsheets by taking online classes through UniversityNow or edX

8. Economist

How to become an economist:

If you want to become an economist, you will need a bachelor’s degree in economics (or a related field) from an accredited university. To get into graduate school, it’s recommended that you have at least 30 credit hours of coursework under your belt.

After completing your undergraduate degree and applying for grad school, you’ll take the GRE or GMAT (depending on which program you’re applying for). You will also have to submit transcripts showing your grades and courses taken during college as well as letters of recommendation from professors or mentors who know your work well.

Once accepted into graduate school, many programs require students complete coursework in mathematics-oriented subjects such as calculus and statistics before beginning their studies toward becoming economists.

9. Financial Analyst

Financial analysts are responsible for analyzing the performance of companies and industries. They’re also known as investment analysts and stockbrokers, but these titles can be misleading—financial analysts don’t actually manage funds or buy and sell stocks on your behalf.

Instead, they help investors make informed decisions about their investments by gathering information about companies’ financial statements, reviewing industry trends and economic factors, conducting interviews with company executives and competitors, etc. They then use this information to create reports that highlight strengths and weaknesses in specific businesses or industries.

Financial analysts are usually employed by banks or other financial institutions—though some may choose to start their own investment firms or consultancies where they work independently on projects for clients.

To become a financial analyst, you’ll need at least a bachelor’s degree in business or finance (either from an accredited university program, online education option such as Walden University Online BA program in Business Administration&#x0026lt

10. Business Development Manager

As a business development manager, you will be responsible for developing profitable relationships with clients and establishing new market opportunities. This means that your responsibilities include researching markets, identifying potential clients and making sales pitches.

Being successful as a business development manager requires strong communication skills, the ability to interact with people from all walks of life and an understanding of financial markets. Most importantly, however you need to enjoy selling; after all this is what you’ll be doing every day!

You can get started on your career as a business development manager by taking courses in finance or marketing at college or university level. There are also many online courses available if you don’t want to go back into education full time. Once qualified it’s often best to gain some experience working at another firm before going out on your own as an independent consultant so make sure that any company offers training programs for new recruits before applying for jobs there

There are many jobs where you could make a lot of money in finance and consumer services

If you’re looking for an exciting, high-paying job in finance and consumer services, there are plenty of options. This list is ranked from highest to lowest salary (in alphabetical order) by difficulty level and required skillset.

- Senior Financial Analyst: You’ll need a bachelor’s degree in business or accounting and five years of prior experience working with financial statements such as balance sheets or profit and loss statements. The senior financial analyst position has an average annual base salary of nearly $45,000—but if you have 10+ years of experience under your belt, it can jump up to over $75K per year!

- Financial Accountant: A bachelor’s degree in accounting is required for this role which includes bookkeeping duties such as account reconciliation and tax preparation services like calculating depreciation schedules or preparing tax filings on behalf of clients who own small businesses or run their own personal finances independently. These professionals tend to make around $60K per year on average; however some senior accountants may earn upwards of $100K annually!

If you’re thinking about a career in finance or consumer services, then this list of jobs should give you some ideas for what to look for.

I went through your blog, It is really nice and informative. Keep sharing more such information.