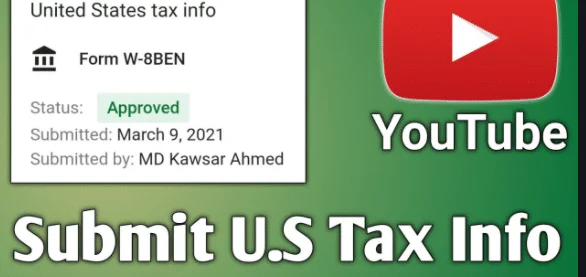

How to Fill And Submit YouTube Tax Form 2022 For 24% Deduction Google AdSense tax information, how to update tax information in google ads, New YouTube update for all creators who earn income through YouTube,

Fill And Submit YouTube Tax Form 2022

regardless of where they are in the world, who are required to provide tax information. Provide your tax information as soon as possible. If your tax information is not submitted by May 31, 2021, Google may be required to provide up to 24% of your global revenue.

You can follow the instructions below to submit your tax information to Google. Please note that you may need to resubmit your tax information every three years.

steps to follow Submit YouTube U.S Tax Info

- AdSense account ._ Click Payments.

- Then click Manage Settings. _ Scroll down to “Payment Profile” and click edit “US Tax Information”.

- Click Manage Tax Information. On this page, you will find a guide to help you select the appropriate form for your tax situation.

- It will take you to this section. “Add Tax info”

- Then click on add tax information

- if you are not American (non-US)

- Click Start W-8BEN FORM

- fill your addresses

- Tax threat for no US citizen Select No

- Preview Your form and then click tik and then next

- Submit

- After fill the required data the next step is this you have to submit your tax form for approve

Leave a Reply