Why candlesticks are important to your trading analysis?

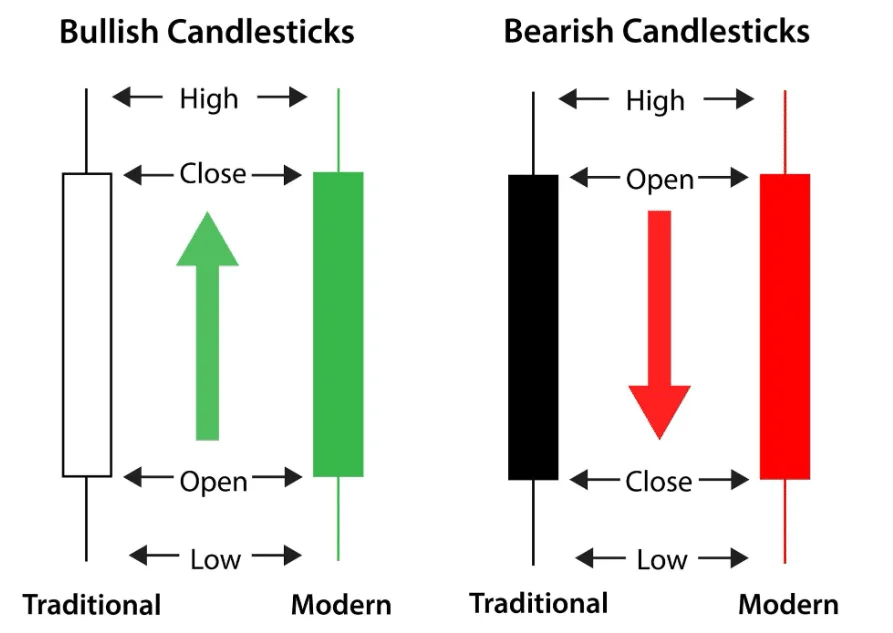

Japanese candlesticks are important to trading analysis because they are

visual representation of what is going on in the market.

By looking at a candlestick, we can get valuable information about

The open, high, low, and close price, which gives us an idea of its

Price action.

Candles are flexible and can be used alone or in combination

Using technical analysis tools such as moving averages, and

Momentum oscillators can also be used with methods such as

Dow theory or Elliott wave theory.

Personally, I use candlesticks with support, resistance, and trend lines And other technical tools.

Always dominates human behavior in relation to money

the fear. Greed and hope candlestick analysis will help us understand

These psychological factors are changing by showing us how buyers are

Sellers interact with each other.

Candlesticks provide more valuable information than bar charts, using

This is a win-win situation because you can get all the trading signals

This bar chart generates additional clarity and signals

Resulting from candlesticks.

Candlesticks are used by most professional traders, banks and hedges

Money, these guys trade millions of dollars every day, they can move

Market whenever they want.

They can easily take your money if you don’t understand the game.

Even if you could trade with a trading account worth one hundred thousand dollars,

You cannot move the market. You cannot control what is going on

Market.

Using candlestick patterns will help you understand what an adult is

They do, and it will show you when to get in, when to get out, and when

Move away from the market.

Leave a Reply